Artificial INtelligence and MAchine LEarning 101 for professionals IN FINANCE & BANKING (PART 1 of 10)

Introduction to AI & ML in Finance & Banking Services

Introduction

This article explores the motivation of Artificial Intelligence and Machine Learning in Finance. Unlike other fields, AI & ML in finance has been in use for a long time.

Throughout history, the intent has not been to replace human workers but to enhance wealth and prosperity with changing times. As the world around us becomes more unpredictable, AI and ML tools can help us carve paths of prosperity through chaos.

With this motivation & perspective, this article presents the history and future of AI & ML in finance in a tone of hope and benign possibilities.

THE MOTIVATION BEHIND AI and ML in FINANCE

The traditional measures of approving loans can’t keep up with the rhythm of today’s workforce. The professional work scene is filled with freelancers navigating their way without the safety net of a steady paycheck, alongside young professionals just starting, their financial footprints too small to be noticed by the big players in finance.

It is this workforce that is largely waiting in the digital queue of financial institutions, asking for loans. The old rules of the game no longer apply. It doesn’t make sense for financial institutions and banks to scrutinize loan applications using rules that don’t reflect the realities of the world.

Then there’s the stock market, that dizzying whirlwind of buy and sell, where fortunes can change in less time than it takes to brew a cup of coffee. Here, success requires an almost magical foresight, a way to predict twists and flicks on top of jumps, strides, and falls.

Amidst all this, there’s the ever-present risk of fraud. In a world awash with transactions, spotting the bad apple in a vast orchard of digital dealings is more challenging than finding a needle in a haystack. This dilemma faces not just individuals but the biggest names in banking, all seeking to shield their customers from harm.

So, how do financial institutions, investors, and regulators navigate these waters? How do we offer loans to those with unconventional earnings, predict the next flicker in the stock market, or catch a fraudulent transaction in a sea of legitimacy—all in real time?

The complexity of these tasks has outgrown the old, rule-based ways.

Welcome to the era of Artificial Intelligence in finance.

AI in finance isn’t just another tool; it’s a guide, a navigator, a protector. It sees beyond the surface, making sense of patterns we can’t, predicting changes with astonishing accuracy, and standing guard over our financial well-being.

Artificial Intelligence doesn’t just solve our problems; it opens new doors. It brings a touch of human insight to the vast data that defines our financial lives, lighting the way forward. With AI, we’re not just keeping pace with the world; we’re reimagining what’s possible in finance, making it more inclusive, predictive, and secure.

This is what makes Artificial Intelligence and Machine Learning more existing in Finance than in any other field. In Finance, AI is not a threat that replaces the human workforce, but a tool that expands human capacity to create more prosperity and wealth.

A Brief History of AI & ML in Finance

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the financial sector is a significant evolution in how financial services are delivered and consumed. This journey, spanning several decades, reflects the broader technological advancements and growing computational power. Here’s a brief history:

1950s-1970s: The Early Days

AI Conceptualization: The concept of AI was first introduced in the 1950s. Although not immediately applied to finance, these early years laid the groundwork for future applications.

Simple Automation: The financial sector began using computers for basic tasks, such as balancing ledgers and managing accounts, which can be seen as a precursor to more advanced AI applications.

1980s: Foundations for AI and ML

Expert Systems: The introduction of expert systems, which could mimic the decision-making ability of a human expert, marked the early use of AI in finance. These systems were used for loan underwriting and fraud detection, though in a very rudimentary form.

Quantitative Models: The 1980s also saw the emergence of quantitative models for market prediction and analysis, laying the groundwork for ML applications in algorithmic trading.

1990s: The Internet Era

Digitalization and Data Availability: The proliferation of the internet and the digitalization of financial services resulted in an explosion of available data, setting the stage for data-driven ML applications.

Early ML in Trading: Some of the pioneering hedge funds and financial institutions began experimenting with ML for algorithmic trading, although these technologies were still in their infancy.

2000s: Expansion and Sophistication

Big Data and Advanced Analytics: The early 2000s witnessed the advent of big data, leading to more sophisticated AI and ML models. Financial institutions started leveraging these technologies for a wider range of applications, including personalized financial advice, risk management, and customer service enhancements.

Machine Learning Takes Center Stage: With advancements in computing power and algorithms, ML models became more sophisticated, enabling more accurate predictions and decision-making in trading, credit scoring, and fraud detection.

2010s-Present: AI and ML Proliferation

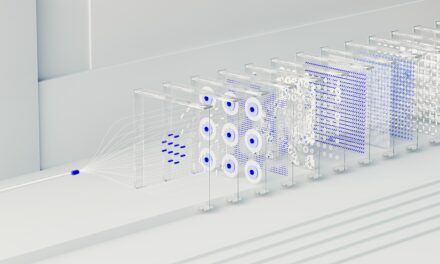

Deep Learning and Neural Networks: The introduction of deep learning and advancements in neural networks have significantly improved the accuracy and capabilities of AI applications in finance. These include natural language processing for customer service bots, enhanced predictive analytics in trading, and more nuanced risk assessment models.

Fintech and AI Integration: The rise of fintech startups brought fresh innovation to the financial sector, extensively using AI and ML to disrupt traditional banking, lending, and investment services.

Regulatory Technology (RegTech): AI and ML have also been applied in regulatory compliance, helping institutions navigate the complex landscape of financial regulations efficiently.

FUTURE OF AI & ML IN FINANCE

Envisioning the future of Artificial Intelligence (AI) and Machine Learning (ML) in the financial sector is like peering through a kaleidoscope of possibilities, each turn revealing patterns more intricate and colors more vibrant than the last. As we stand on the cusp of this unfolding era, a few key themes and developments paint a compelling picture of what lies ahead.

Hyper-Personalization of Financial Services: The future promises a financial landscape where services are not just tailored to the individual but are anticipatory, predicting needs and offering solutions before the customer even realizes they are needed. AI and ML will drive this hyper-personalization, using data to craft financial advice, product offerings, and customer experiences that are as unique as fingerprints.

Democratization of Financial Advice: Robo-advisors, already making investment advice more accessible, will evolve to offer more complex and nuanced financial planning services, traditionally the domain of high-net-worth individuals. AI-driven platforms will provide comprehensive financial advice, covering everything from investments to retirement planning, to a broader audience at a fraction of the current cost.

Enhanced Risk Management and Compliance: Risk management and compliance are areas ripe for AI and ML innovation. Future systems will predict and mitigate risks with greater accuracy, using real-time data analysis to navigate the ever-changing regulatory landscape. This will not only protect institutions and their clients but also streamline operations, reducing the need for cumbersome manual oversight.

Revolutionizing Credit and Lending: AI and ML will transform credit assessment and lending by leveraging more non-traditional data sources to evaluate creditworthiness. This will enable more nuanced and equitable lending decisions, fostering financial inclusion and empowering underserved communities.

Advancements in Fraud Detection and Cybersecurity: As financial transactions become increasingly digital, the arms race between institutions and fraudsters will intensify. AI and ML will lead the charge in developing more sophisticated, adaptive systems for detecting and preventing fraud in real-time, safeguarding assets and information with unprecedented precision.

The Integration of AI Ethics in Financial Decision-Making: With AI and ML assuming greater roles in financial decision-making, ethical considerations will come to the forefront. The financial sector will need to address biases in AI algorithms, ensuring decisions are fair and equitable. This will involve not just technological solutions but a broader dialogue on the values we wish to uphold in our financial systems.

The Emergence of New Financial Products and Services: Finally, AI and ML will be the birthplace of financial products and services yet imagined. Just as the internet gave rise to entirely new sectors within finance, AI and ML will pave the way for innovations that today seem like the stuff of science fiction, from AI-driven investment vehicles to new forms of currency and payment systems.

In the grand tapestry of the financial sector’s future, AI and ML are not merely threads but the loom itself, shaping the fabric of finance in profound and enduring ways.