Artificial INtelligence and MAchine LEarning 101 foR professionals IN FINANCIAL AND BANKING SERVICES (PART 3 of 10)

How AI Automates Credit Underwriting and Decisioning PROCESSES in Banks

Introduction

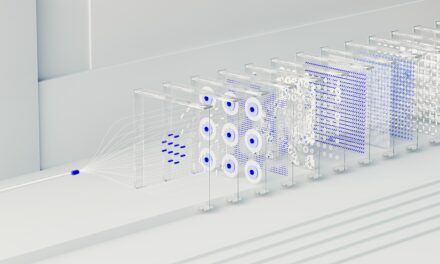

In the last article, we looked at the core concepts of AI in the context of Financial Systems. We explained what AI systems are made up of. We also explained important concepts – machine learning algorithms, data science, neural networks, deep learning, supervised learning, unsupervised learning, and Natural Language Processing (NLP)

Core Concepts of AI & ML for Professionals in Financial and Banking Services

With this understanding now it will be easy for you to understand how AI is used in Credit Underwriting and Decisioning in Banks. You will also be able to appreciate the role that data science and machine learning algorithms play in this automation.

So in this article, we will help you understand the key areas where AI is used in the Credit Card / Loan Application approval process. We will explain in a simplified way what AI is used for in these key areas. We will also touch upon the ML algorithms that are used therein.

INTRODUCTION

The integration of AI into the credit underwriting and decision process reshapes operational and process-level workflows within banks, credit unions, NBFIs, and FinTechs. These changes touch upon various aspects of the credit lifecycle, from initial application to final decision, impacting both the efficiency and quality of credit assessments. Here’s an overview of how AI transforms these processes:

Initial Application Processing

Before AI:

– Applications are manually reviewed for completeness and initial eligibility.

– Preliminary assessments are based on simple, rule-based systems.

After AI:

– Automated systems instantly verify application completeness and pre-assess eligibility using AI algorithms.

– Initial sorting and prioritization of applications are based on AI-driven predictions of creditworthiness and potential risk.

Data Collection and Analysis

Before AI:

– Data collection focused primarily on traditional financial metrics (e.g., credit scores, income).

– Manual gathering of additional information, if needed, is slow and cumbersome.

After AI:

– AI systems automatically pull in a wide range of data, including traditional financial metrics and alternative data sources (e.g., rent payments, utility payments, social media behavior).

– Data analysis is significantly more sophisticated, leveraging machine learning to identify patterns and insights across large datasets.

Risk Assessment and Decision Making

Before AI:

– Risk assessment was based on static models that might not account for recent market changes or the full scope of an applicant’s financial situation.

– Decisions were made through a combination of manual review and simple automated scoring systems.

After AI:

– Dynamic risk models continuously learn from new data, allowing for real-time adjustments to risk assessments.

– Decisions are made through complex algorithms that consider a broader array of factors, resulting in more nuanced and individualized credit decisions.

AI in Initial Application Processing

Many fintech and neo banks have started using this strategy where the initial screening of applications is done by AI. Those applications that meet the bank’s criteria get evaluated first. The applications that get filtered out are sent for further review. This creates efficiency at scale.

Imagine a bank receiving a credit card application from an individual named Alex. In the traditional process, a bank employee would manually check Alex’s application for completeness, verify basic eligibility criteria, and then forward it for detailed assessment. This could take anywhere from a few hours to several days.

Alex’s credit card application can be processed and approved faster once AI is used in the process. Let’s see how

Preliminary Eligibility Check: Using predefined criteria and machine learning models, the AI system can quickly assess Alex’s basic eligibility for the credit card. For example, it checks against minimum income requirements, age, and residency status.

The essence of leveraging ML at this stage is to quickly assess whether an applicant meets the basic criteria for loan consideration before proceeding to a more detailed underwriting process. More criteria can be added to qualify Alex’s application like his utility bill payments and education qualification. ML algorithms can process these conditions.

Logistic Regression, Random Forests, and Gradient Boosting Machines are the most suitable machine-learning algorithms for this purpose.

Fraud Detection: To make sure Alex’s application is authentic system can also run the application through an ML-based fraud detection algorithm, comparing details against known fraud patterns and checking for inconsistencies that may suggest identity theft or application fraud.

By identifying potentially fraudulent applications early, the bank reduces the risk of financial loss and protects genuine customers’ interests.

The ML model used for fraud detection can produce several outputs that help in assessing the risk of fraud in Alex’s application:

Fraud Probability Score: A score representing the likelihood that Alex’s application is fraudulent. Applications with a score above a certain threshold might be flagged for further review.

Risk Indicators: Specific factors or patterns detected by the models that contribute to the fraud probability score, such as inconsistencies in application data compared to historical or external data.

Recommendation for Action: Based on the fraud probability score and risk indicators, the system might recommend actions such as approving the application, rejecting it due to the high risk of fraud, or flagging it for manual review by a fraud analyst.

Random Forrest, Gradient Boosting Machines, and Anomaly Detection Algorithm are the most suitable ML algorithms for this purpose.

Predictive Scoring: Even at the initial stage, AI can generate a preliminary risk score based on the extracted data, utilizing not only the information provided in the application but also external data sources where permitted (e.g., credit bureaus, and public records).

This provides an early indication of the applicant’s creditworthiness, guiding the prioritization of applications for further review and speeding up the overall decision process.

Again, Logistic Regression, Random Forests, and Gradient Boosting Machines are the most suitable machine-learning algorithms for this purpose.

The primary output from these models is creditworthiness score, default probability, credit limit recommendations, and risk categories.

AI-Powered Credit Risk Assessment

After an initial assessment of the application comes the credit risk assessment phase. AI is extensively used here.

Imagine a bank named “FutureBank” that wants to modernize its loan approval process by incorporating AI into its credit risk assessment. The goal is to improve the accuracy of loan approvals, reduce defaults, and offer more personalized loan products. This is how AI will transform their services.

Data Collection: Traditional data collection focuses primarily on applicant-provided information, such as income, employment history, and credit scores, which are manually entered into the bank’s system.

FutureBank’s AI system automatically gathers data from a wider array of sources, including traditional credit reports, bank transaction histories, and even alternative data such as utility payments, rental history, and online shopping behavior. The system uses APIs to fetch real-time data from various databases and online sources. As you have seen in the previous article data is key to building AI systems. The advantage of AI systems is their ability to correlate various types of data. Hence data collection is a critical step in Future’s Banks credit risk assessment AI system.

Data Processing and Cleanup: Manual data processing involves sorting through applications, verifying information, and correcting errors, a process prone to delays and mistakes.

Future Bank’s AI system uses machine learning algorithms to cleanse and preprocess the data automatically. It identifies and corrects inconsistencies, fills missing values based on predictive modeling, and formats the data for analysis. In this phase, Future Bank can use Isolation Forest and DBSCAN algorithms for identifying outliers, while K-nearest neighbors and predictive algorithms are suitable for handling missing values. Specialized algorithms can be used for data transformation, feature encoding, and feature selection.

Risk Assessment: Traditionally analysts use simple models and scorecards to evaluate credit risk based on a limited set of variables, often overlooking nuanced patterns or relationships between data points.

In this stage, FutureBank’s AI can employ machine learning algorithms, like Logistic Regression, Gradient Boosting Machines, XGBoost, Support Vector Machine, and even deep learning, to analyze the collected data. Using these algorithms AI can examine hundreds of variables, detecting complex patterns and relationships that human analysts might miss. For example, the AI might find that a combination of small, regular savings deposits, a stable monthly expenditure pattern, and timely utility payments are strong indicators of low credit risk, even for applicants with thin credit files.

Predictive Risk Modeling: Typically, Banks rely on static risk models that get updated infrequently, leading to outdated assessments that don’t account for recent economic changes or trends.

Future Bank’s AI system can continuously learn and update its models based on new data and outcomes. It can predict an applicant’s likelihood of default with high accuracy by simulating various economic scenarios and applicant behaviors.

Again, Logistic Regression, Random Forests, and Gradient Boosting Machines are the most suitable machine-learning algorithms for this purpose.

Why Data is Collected from Many Data Sources in AI Systems

One might wonder why AI system automation demands so many data sources. Couldn’t this be done in manual systems as well, where a large set of data could be presented to a human evaluator and they could utilize the data to make decisions?

The advantage of AI in collecting a wide range of data over manual evaluations lies in its capacity to handle vast volumes of information efficiently and its ability to uncover insights from complex, unstructured data that manual processes cannot easily replicate. In manual processes, there is a limit to how much data you can meaningfully analyze. Here are the reasons why large sets of data work best in AI-based automation.

Scale and Efficiency: AI Systems can process and analyze data from thousands of applications simultaneously and almost instantly. This level of scalability and efficiency is simply not achievable with manual processes, especially as the volume of data grows exponentially with the inclusion of digital and social media footprints, transaction histories, and other online behaviors.

Real-time Data Analysis: AI can analyze data in real time, allowing for immediate decision-making. This is crucial in dynamic environments like financial markets or fraud detection, where conditions change rapidly. Manual processes, due to their time-consuming nature, cannot match the real-time capabilities of AI.

Complex Pattern Recognition: AI, particularly through machine learning and natural language processing, can analyze structured and unstructured data (e.g., text, images, social media activity) to extract valuable insights. Manual evaluations are generally not equipped to process and interpret unstructured data at a large scale efficiently.

Predictive Insights: Beyond processing existing data, AI can use historical data to make predictions about future behaviors, such as potential loan default risks. While manual evaluations can also use predictive models, AI can incorporate more variables and more complex relationships between them, resulting in more accurate predictions.

Continuous Learning and Improvement: AI systems can continuously learn from new data, improving their accuracy and effectiveness over time without explicit reprogramming. Manual systems rely on periodic updates and revisions, which can be slow and may not capture new patterns or trends as effectively.

Tailored Approaches: AI can tailor data collection and analysis to individual cases, providing personalized assessments based on an applicant’s unique data profile. This level of customization is challenging to achieve in manual evaluations without significant resource expenditure.

Accessibility and Inclusivity: By considering a wider array of data points, AI systems can often provide opportunities for individuals who might be marginalized by traditional credit scoring methods, such as those with thin credit files or non-traditional employment patterns.

CONCLUSION

In this article, we gave a simplified explanation of how AI is used in banking for credit risk assessment. We also explained how data and data sources play such an important role in making AI effective.

In the next article, we will look deeply into the role of data in AI and ML.