Artificial INtelligence and MAchine LEarning 101 foR professionals IN FINANCIAL AND BANKING SERVICES (PART 4 of 10)

An Overview of Machine Learning Models in Banking and Finance

Introduction

In the previous article, we explored how data is utilized in machine learning models for both training and analysis. We discussed the various types of data that machine learning models ingest to generate predictions. In this installment, we’ll delve into the various machine-learning models employed within the financial sector and explain supervised and unsupervised modes of learning. Let’s dive in.

Statistical models have a longstanding history in the banking and finance sectors. Traditionally, these models have been static or rule-based, relying on predetermined formulas to make predictions. However, machine learning models operate differently.

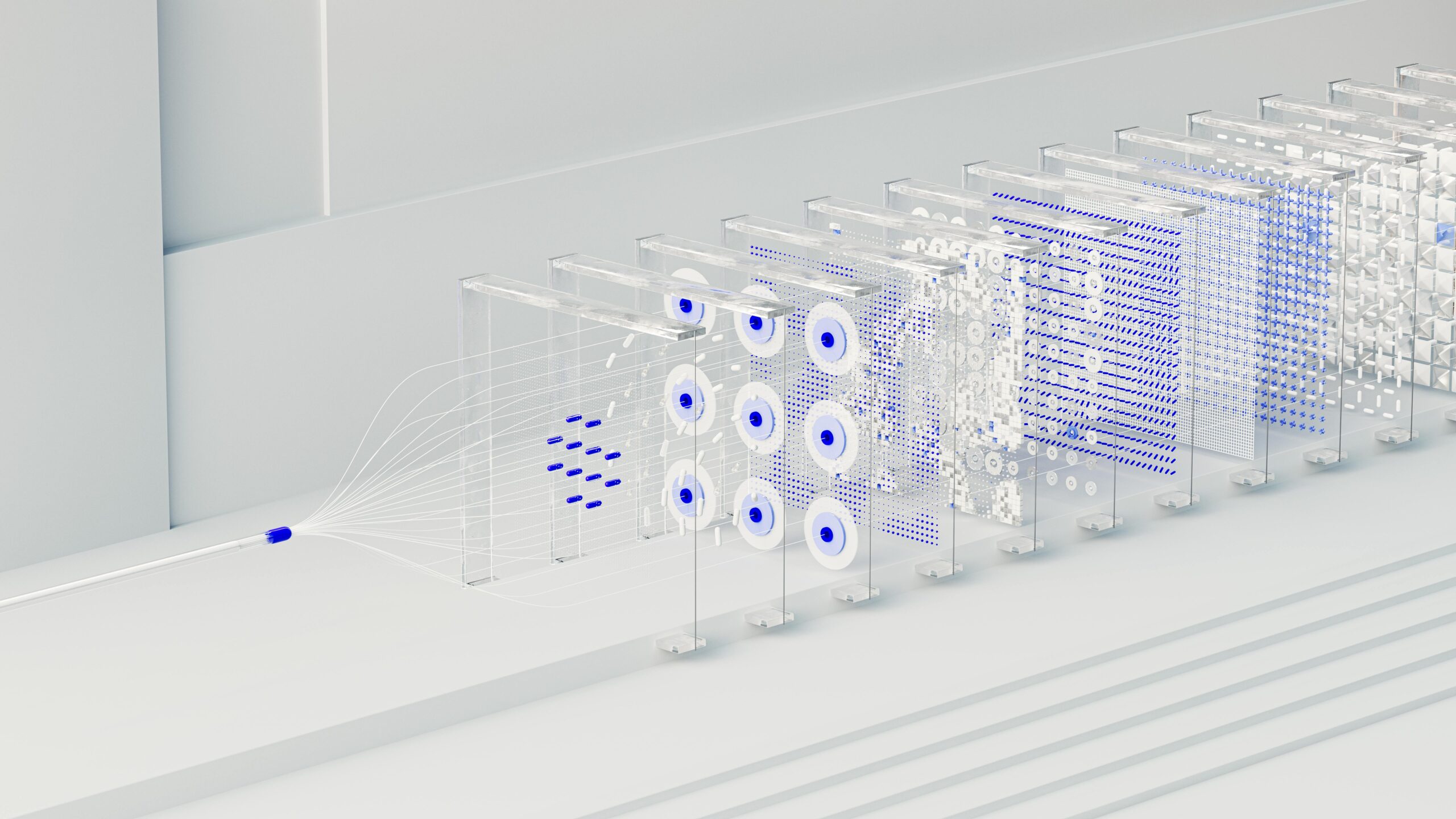

Machine learning algorithms dynamically utilize historical data to construct models. These models are composed of ‘weights’ assigned to different data features, which are continuously optimized through the training process. This optimization allows the models to make increasingly accurate and generalized predictions.

We will now examine the diverse problems that machine learning models address in the finance and banking industries.

Types of Problems that Machine Learning Models Solve in Banking and Finance

Classification Problem: This is about determining which category an object belongs to. For example, deciding whether a transaction is fraudulent or not, or classifying loan applicants as high risk or low risk.

Regression Problem: Predicting a numeric value. For example, forecasting future values of stock prices or estimating the creditworthiness of a borrower in terms of a credit score.

Clustering Problem: Grouping sets of objects that share similar characteristics without prior labeling. For example, segmenting customers based on their spending habits or investment behaviors can inform personalized marketing strategies.

Dimensionality Reduction: Simplifying large sets of data into more manageable forms while retaining essential information. This can be critical in risk management where simplifying complex datasets into key risk factors can help in more effective monitoring and decision-making.

Anomaly Detection: Identifying unusual patterns that deviate from the norm. This is crucial in fraud detection systems within banks, helping to identify and alert suspicious account activities that could indicate fraud.

Now let us look at different models that are used in finance and banking.

Types of Models

- Linear Regression: A model that predicts a continuous value based on the linear relationship between input variables. It’s used when you expect a straight-line relationship between variables. Use Case: Predicting loan interest rates based on factors like credit scores, loan amount, and economic indicators.

- Logistic Regression: Despite its name, logistic regression is used for classification tasks, especially binary classification. It predicts the probability of an event occurring, like whether a customer will default on a loan. Use Case: Determining the likelihood of a fraudulent credit card transaction based on transaction characteristics.

- Decision Trees: This model uses a tree-like model of decisions and their possible consequences. It’s like a flowchart that helps make decisions by splitting data into branches at each level based on decision rules. Use Case: Evaluating loan applicants by branching out various criteria such as income level, employment status, and previous credit history to decide on loan approval.

- Random Forests: An ensemble of decision trees designed to improve accuracy and control over-fitting. Random forests combine the output of multiple decision trees to come up with a final answer. It is a classification model. Use Case: Used in credit scoring to assess the risk of lending to potential borrowers by considering various factors across multiple decision trees to improve prediction reliability.

- Support Vector Machines (SVM): A powerful classification technique that works well on linear and non-linear data. It finds the best boundary that separates classes of data. Use Case: Classifying investment opportunities as high risk or low risk based on features like market volatility, past performance, and economic indicators.

- Clustering Algorithms (e.g., K-means): Used to group sets of objects in such a way that objects in the same cluster are more similar to each other than to those in other clusters. This is useful for discovering natural groupings in data. Use Case: Segmenting customers based on their spending habits to tailor marketing strategies.

- Gradient Boosting Machines (GBM): An ensemble technique that builds models sequentially, each new model correcting errors made by the previous ones. It’s highly effective for predictive tasks where accuracy is crucial. Use Case: Enhancing predictive accuracy in credit scoring and default prediction.

- Principal Component Analysis (PCA): A dimensionality reduction technique that transforms a large set of variables into a smaller one that still contains most of the information. It’s used to simplify data without losing much information. Use Case: Reducing the number of variables in a large dataset of investment assets to identify key factors influencing asset returns.

- Neural Networks: Inspired by the human brain, these models are particularly good at capturing complex patterns in data through layers of neurons. They are versatile and can be used for both regression and classification tasks. Use Case: Detecting patterns in transaction data to identify fraudulent activities or high-frequency trading algorithms.

This overview should serve as a solid introduction to the diverse models used in banking and finance. A critical requirement in this sector, driven by regulatory demands, is the explainability of models. Stakeholders must be able to articulate why a model made a specific decision. For instance, if a logistic regression model determines that an applicant is likely to default on a loan, it’s important to identify and explain the contributing factors—such as a low credit score, anomalies in financial statements, or inconsistencies in utility bill payments.

In future articles, we will delve deeper into each model, exploring their underlying algorithms and how they are applied to solve real-world problems in the financial industry.

Two Types of Learning

Now let’s explore the two primary types of machine learning, differentiated by their learning approaches: supervised learning and unsupervised learning.

Supervised Learning: Supervised learning involves training a model on a labeled dataset, which means that each input data point is paired with an output label. The goal is to teach the model to learn the relationship between the inputs and the outputs so it can predict the output for new, unseen data.

This type of learning is used when the historical data includes the correct answers (labels). Common applications include regression (predicting continuous values) and classification (predicting discrete categories).

Supervised learning is used in building the following models: Linear Regression, Logistic Regression, Decision Trees, Support Vector Machines (SVM), Neural Networks, Random Forests, and other ensemble methods.

Unsupervised Learning: Unsupervised learning involves training a model on data without labeled responses, i.e., the data has no explicit output associated with it. The goal here is to discover the underlying structure of the data and identify patterns, groupings, or relationships without the guidance of a known output variable.

This type of learning is used when you want to explore the data to find patterns or group data in clusters. Clustering problems are usually solved using unsupervised learning models. It’s also used for dimensionality reduction, which helps in reducing the number of variables under consideration.

The models in this category include Clustering Algorithms, K-means Clustering, Hierarchical Clustering, Association Rule Learning, Principal Component Analysis (PCA), and Autoencoders.

Another type of machine learning is reinforcement learning. This method focuses on training an agent to make decisions that maximize a cumulative reward in a given environment. The agent learns through trial and error, identifying which actions lead to the highest rewards. In the banking sector, this approach is often applied to algorithmic trading, where the system continuously adapts its buying and selling strategies to optimize financial returns over time.

SUMMARY

In this article, we explored various categories of problems that machine learning algorithms address within the banking and finance sectors. We discussed the different models used and their specific applications. We also clarified the concepts of supervised and unsupervised learning.

In our next installment, we will delve into deep learning and examine its role and applications in banking and finance.