Artificial INtelligence and MAchine LEarning 101 foR professionals IN FINANCIAL AND BANKING SERVICES (PART 2 of 10)

Core Concepts of AI and ML for Financial and Banking Services

Introduction

In the previous article, we laid out the motivation behind using Artificial Intelligence and Machine Learning in the financial industry. We gave a perspective on how the financial and banking industry has evolved from the usage of statistical models to Machine Learning. Then we extended the story to show what can be expected in the future.

In this article, we will look at the core concepts of AI in the financial industry. We will explain the key concepts of Data Science, Machine Learning in simplified and easy to understand manner for professionals in the financial and banking industry.

DIFFERENT APPLICATIONS OF AI in Financial and Banking Services?

The need to integrate AI in financial industry arises from a combination of factors – increased complexity, dynamic market conditions, evolving business models, and the sheer volume of data generated daily. Below, we briefly explore the business and operational needs driving the adoption of AI in key areas:

Risk Management: Financial markets have become increasingly complex, with a vast array of investment products and services. AI can help manage this complexity by analyzing multiple risk factors and their interdependencies more efficiently.

Moreover, the fast-paced nature of financial markets requires that risk assessment be done in real time, which AI can provide by continuously analyzing market conditions and predicting potential impacts on portfolios.

Fraud Detection and Prevention: As digital transactions are becoming the norm, the methods used by fraudsters have become more sophisticated. AI systems can adapt to these changing patterns, identifying and preventing fraud more effectively than traditional methods.

Manual detection of fraud is time-consuming and prone to errors. AI can automate and enhance the accuracy of fraud detection processes.

Credit Underwriting and Decisioning: The availability of big data has made traditional credit scoring models outdated. AI can process vast datasets, including non-traditional data, to provide more accurate and personalized credit assessments.

Moreover, there’s a growing need to extend credit to underserved markets. AI can enable financial institutions to understand these new customer segments better and offer tailored financial products.

Trading: Financial markets are more volatile and interconnected than ever, necessitating tools that can quickly analyze and react to global events. AI can provide these capabilities, enhancing decision-making and trading strategies.

In the quest for better returns, trading firms typically use AI to develop sophisticated algorithms that can identify and act on market opportunities faster.

Regulatory Compliance: With the financial industry facing an ever-growing and changing regulatory landscape, compliance has become increasingly complex. AI tools can simplify compliance by automating the monitoring and reporting processes, ensuring accuracy and timeliness.

Manual compliance processes are costly and labor-intensive. AI can significantly reduce these costs by automating routine compliance tasks, allowing human experts to focus on more complex issues.

HOW AI in Finance and BANKING DIFFERENT FROM POPULAR USES OF AI?

Artificial Intelligence (AI) is about endowing computers with capabilities to solve complex problems traditionally requiring human-like perception, cognition, learning, expertise, experience, and problem-solving skills.

Typically popular applications of AI are linked to capabilities like image recognition or natural language processing. These are challenging tasks. From a computer’s perspective, these are advanced human cognitive abilities. For instance, a child can effortlessly recognize a cat in an image or can recognize that a cloud in the sky is the shape of a cat. Can such a feat be carried out by traditional computer algorithms? The evolution of Generative AI has been in this direction – for computers to mimic human cognition. This is now evidenced in products like ChatGPT, Gemini, Dall-E, and Sora.

Similarly, AI manifests in autonomous systems such as cleaning robots. These robots navigate and clean homes without predefined maps or explicit instructions, learning and adapting to their environment over time. This autonomy and adaptability underscore AI’s broader definition: the ability to independently gather information, mimic human cognition, learn from experiences, and make decisions that are beneficial and meaningful to humans.

In the financial sector, AI’s application transcends replicating human tasks. It is more about venturing into solving problems of greater complexity than humans typically can, typically those requiring nuanced judgment and expertise. Consider the process of loan application approval: an experienced credit underwriter assesses various risk factors to determine an application’s viability. Similarly, in trading, seasoned traders leverage algorithms, charts, and market trends for more accurate predictions.

AI in finance thus assumes a role beyond mere human capability replication; rather it enhances expert-level decision-making, achieving feats beyond even human experts’ reach. Moreover, in financial and banking applications Compliance, Ethics and Fair Use of AI is non-negotiable.

Machine Learning Model - The brain of AI Systems in Financial Applications

At the heart of all AI applications is a common factor: data. For instance, credit underwriting AI systems use a mix of non-traditional data and applicants’ credit histories to make their judgment on loan eligibility. In algorithmic trading, analysis of past historical stock value and current market trend data is crucial.

Why is data so vital for AI systems? For AI to make intelligent predictions or analyses, it must first learn from data. Learning means identifying patterns and relationships within the data through extensive trial and error. This is done through Machine Learning.

Before machine learning came onto the scene, rules-based systems and statistical methods were used to find patterns in datasets. These methods would discover relatively simple relationships between data elements. For example, certain rule-based engines were built to find fraudulent transactions, and statistical models were used to find optimal portfolio allocation.

But with the arrival of big data in the scene and the increase in complexity of analyses expected from AI systems, Machine Learning has become a de facto approach for analysis and making predictions.

Today, there is a machine learning model in every AI system.

Take the machine learning model underpinning a Credit Underwriting AI as an example. It learns from a combination of non-traditional datasets and credit histories, understanding the correlation between a borrower’s creditworthiness and various factors that can affect it, such as social media activity, spending patterns, utility bill payments, educational background, etc.

Designing an AI system is a deliberate process tailored to find a relationship between data elements. You start by deciding on the analysis you want and the data at your disposal. For example, you want to find out the creditworthiness of applicants and you have utility bill payment history, education background, and 50 other data sources available. Then you pick relevant data elements from these sources and choose an appropriate machine-learning algorithm to create an ML model

While “AI” often refers to the entire system designed for tasks like intelligent credit underwriting, risk management, or algorithmic trading, machine learning (ML) is a data modeling algorithm used within the AI system.

Think of the machine learning model as the brain of the AI system – it does the actual task of figuring out the relationship between data to make predictions and complex analyses.

When you put together the financial data sources, data pipeline, machine learning models, data outputs, and data feedback, automate the process, and put it to use in a live financial application, then the system that you get is an AI.

With this overview let us now understand the key concepts of AI and ML.

Key Concepts of AI & ML

1. Data Science

Data Science is an interdisciplinary field that uses scientific methods, processes, algorithms, and systems to extract knowledge and insights from structured and unstructured data. It combines aspects of statistics, mathematics, programming, and domain expertise to analyze data and derive actionable insights. In AI, data science is foundational because it sets the stage for machine learning algorithms to analyze data.

Machine learning models are prepared by a process called training. For this process, appropriate data has to be fed to machine learning algorithms. This is where data science becomes crucial

Steps Used in Training Machine Learning Models

Data Collection and Preparation: Before machine learning models can be developed or trained, relevant data must be collected. This data can come from a variety of sources, including financial transactions, market data, social media, and more. Once collected, the data must be cleaned and preprocessed to remove inaccuracies, inconsistencies, and irrelevant information. This step is crucial for ensuring the quality and reliability of the model’s outputs.

Feature Engineering: This involves selecting, modifying, or creating features (variables) from the raw data for creating machine learning models. New features can also be added to an existing model to improve its performance. In finance, this could mean deriving new financial indicators from existing market data that could better predict market movements or customer behavior.

Data Analysis and Visualization: Data scientists use statistical analysis and visualization techniques to explore and understand the data. This can reveal patterns, trends, and correlations that might not be immediately obvious but are vital for building effective ML models. For example, visualizing the correlation between different financial indicators and stock performance can help identify key predictors of market movements.

Model Development and Evaluation: This step involves selecting the appropriate ML algorithms, training the models on the prepared data, and evaluating their performance. This is not a one-time activity. Models can evolve with time. Hence, this is an iterative process. For example, as the financial market evolves and new data becomes available the models can be trained on it to provide more contemporary results.

2. Machine Learning Algorithms

Machine Learning algorithms are the backbone of an AI system. They dictate how a computer should analyze data, learn from it, and make predictions or decisions based on the learning. The sophistication and efficiency of these algorithms determine the effectiveness of AI applications.

Machine Learning algorithms are used to create machine learning models (the brain of an AI system). To look at it simplistically, a machine learning (ML) model essentially consists of a structured framework of weights and probabilities called parameters of the model. Values are assigned to the parameters by the algorithm through a process called training.

In the training process, the algorithm creates and adjusts the model’s parameters. The adjustment of parameters is what is termed learning. The goal of learning is to minimize errors and enhance the model’s predictive accuracy. Upon completion of the training phase, the model is tested with additional data. Multiple rounds of training and testing can be done with different sets of data.

Once the machine learning model is ready it can process new, unseen data inputs, and using its learned parameters generate relevant outputs and predictions.

Different types of algorithms are used for solving different types of problems. Let us look at the types of algorithms used in financial AI systems.

Classification Algorithms: These are used to categorize data into predefined classes or groups. Two common applications are, identifying whether a transaction is fraudulent or legitimate and classifying loan applicants as low-risk or high-risk. Algorithms in this category are Decision Trees, Support Vector Machines (SVM), and Logistic Regression.

Regression Algorithms: These predict continuous outcomes, such as forecasting stock prices or interest rates based on historical data. Algorithms in this category are Linear Regression, Polynomial Regression, and Lasso Regression.

Clustering Algorithms: These algorithms are used for grouping sets of data with similar characteristics without predefined categories, which can be useful in market segmentation or identifying patterns in customer behavior. Algorithms in this category are K-Means, Hierarchical Clustering, and DBSCAN.

Reinforcement Learning: This type of algorithm learns through trial and error, refining its strategy over time to maximize a reward. It’s often used in algorithmic trading to develop strategies that adapt to changing market conditions. Algorithms in this category are Q-Learning, Deep Q Network (DQN), and Policy Gradients.

Time Series Algorithms: Used for Economic forecasting and market trend analysis. Algorithms in this category are ARIMA (Autoregressive Integrated Moving Average), LSTM (Long Short-Term Memory) networks.

Natural Language Processing (NLP): Typically, a neural network-based algorithm that can identify patterns in human language. Used in sentiment analysis for market predictions. Algorithms in this category are BERT (Bidirectional Encoder Representations from Transformers) and GPT (Generative Pre-trained Transformers)

Algorithm Selection, Training, and Evolution Cycle

Choosing the right algorithm depends on the specific problem you’re trying to solve, the nature of the data available, and the desired outcome. Training an algorithm involves feeding it a large set of data so it can learn the patterns or characteristics of that data. Over time, the algorithm adjusts its parameters to improve accuracy and efficiency based on feedback from its successes and failures.

ML algorithms are not static; they evolve. As more data becomes available, these algorithms can be retrained to improve their performance. This adaptability is crucial in the financial sector, where market conditions and economic indicators are constantly changing.

3. Neural Networks and Deep Learning

Neural Networks and Deep Learning represent advanced facets of Machine Learning (ML), drawing inspiration from the human brain’s architecture and functioning. They are crucial in tackling complex problems that require the analysis of vast amounts of data and features. They are relevant in the financial sector for tasks such as fraud detection, risk management, and customer behavior analysis.

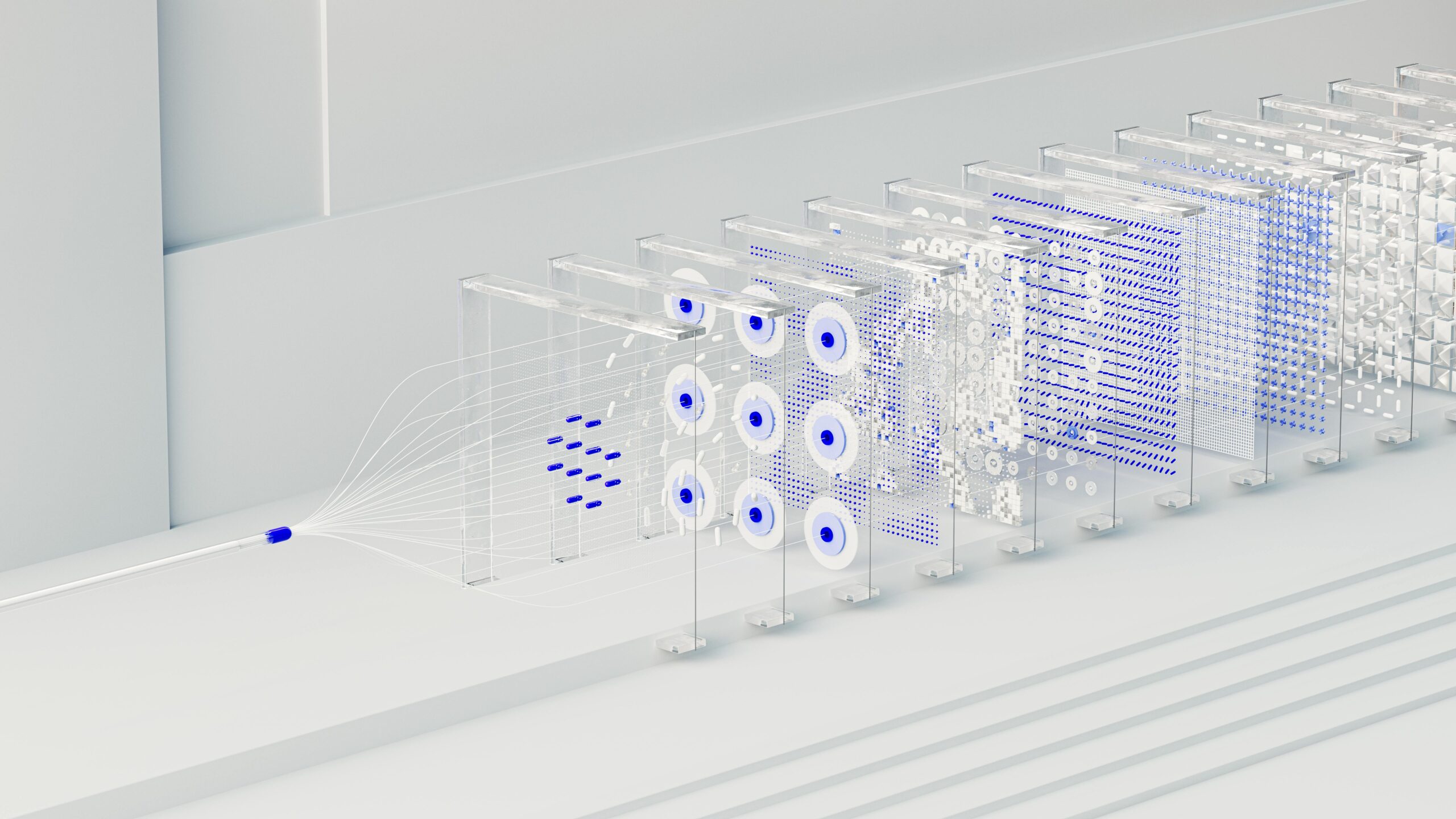

Neural Networks (NNs): At their core, Neural Networks consist of layers of nodes, often called neurons, interconnected to form a network. Each neuron processes inputs and passes its output to the next layer, mimicking the biological processes of the human brain.

The input layer receives raw data, which is then processed through one or more hidden layers that extract features and patterns. The final layer, known as the output layer, delivers the prediction or classification result.

NNs are employed for credit scoring by analyzing customers’ financial histories and transaction patterns to predict creditworthiness, among other applications.

Deep Learning (DL): Deep Learning involves using neural networks with multiple hidden layers, known as Deep Neural Networks (DNNs). The “deep” in Deep Learning refers to the number of layers through which the data is transformed. More layers allow for the modeling of complex patterns at different levels of abstraction.

Deep Learning models can automatically discover the representations needed for feature detection or classification from raw data, significantly reducing the need for manual feature extraction.

Training and Learning: Both Neural Networks and Deep Learning models require training, where the model learns to make predictions or classify data based on input-output pairs. This training involves adjusting the weights of the connections in the network through a process called backpropagation.

4. Supervised and Unsupervised Learning

Machine Learning (ML) models are typically categorized based on the learning approach they utilize: Supervised Learning and Unsupervised Learning. The difference in approaches arises from how an algorithm learns from data.

Supervised Learning: Supervised Learning involves training a model on a labeled dataset, which means that each training example is paired with an output label. The model learns to predict the output from the input data during the training process.

The algorithm iteratively makes predictions on the training data. It compares its predicted output with the actual labeled output. Then it adjusts its parameters learning the mappings from inputs to outputs. The aim of adjusting is to minimize the difference between the predicted and actual outputs.

Supervised learning is extensively used for credit scoring, where models predict credit risk based on historical borrower data with known outcomes. It’s also used in predictive analytics for stock prices, where past data with known results guide the model’s predictions for future stock movements.

Unsupervised Learning: In contrast, Unsupervised Learning involves training a model on data that has not been labeled, meaning the model tries to find patterns and relationships in the data without any explicit instructions on what to predict.

The model explores the structure of the data to identify patterns, groupings, or correlations among data points. This process is useful for discovering hidden structures in data without preconceived labels.

Unsupervised learning algorithms are often applied in anomaly detection for fraud detection, identifying unusual patterns that could indicate fraudulent activity. They are also used for clustering customers based on their purchasing behaviors or investment patterns, providing insights into market segmentation.

Key Differences

Supervised learning requires a dataset with labeled input-output pairs, while unsupervised learning can work with unlabeled data.

Supervised learning is typically more straightforward to implement and interpret but requires substantial and well-labeled training data. Unsupervised learning, while more complex and exploratory, offers valuable insights in the absence of labeled data and can uncover previously unknown patterns.

Both learning types are used in the financial industry, serving different but complementary purposes.

5. Natural Language Processing (NLP)

Natural Language Processing (NLP) stands at the intersection of AI and linguistics, representing a crucial domain of AI focused on enabling machines to understand, interpret, and generate human language. NLP combines computational linguistics—rule-based modeling of human language—with statistical, machine learning, and deep learning models. This combination allows computers to process and analyze large amounts of natural language data, bridging the gap between human communication and machine understanding.

How NLP Works

Text Analysis: At its core, NLP involves analyzing text to understand its semantics, syntax, and sentiment. This can include tasks like part-of-speech tagging, named entity recognition, and sentiment analysis.

Language Models: NLP uses language models—probabilistic machine models of language—to predict the likelihood of a sequence of words. These models are fundamental for tasks such as text generation, translation, and autocorrection.

Applications in Finance

Sentiment Analysis: NLP is used to gauge market sentiment by analyzing financial news, social media posts, and analyst reports, helping predict market trends based on the public’s mood.

Regulatory Compliance Monitoring: NLP can automate the monitoring of compliance with financial regulations by analyzing communication and documents against regulatory requirements and identifying potential non-compliance issues.

Customer Service: Financial institutions employ NLP in chatbots and virtual assistants to provide real-time, efficient customer service, handling inquiries and transactions through natural language commands.

Fraud Detection: NLP contributes to fraud detection by analyzing communication and transactions for patterns and anomalies that may indicate fraudulent behavior.

CONCLUSION

In this article, we explained the core concepts of Artificial Intelligence and Machine Learning. We showed why AI & ML have become important topics in finance and banking. Then we explained in easy-to-understand words what AI and ML are. We explained the most important AI and ML concepts that every professional in finance and banking must understand – Data Science, Machine Learning Algorithms, Neural Networks, Deep Learning, Supervised Learning, Unsupervised Learning, and Natural Language Processing.

Now that you understand the core concepts, next we will show how AI is transforming the financial and banking industry.